The best savings account in Malaysia with a high interest rate is a must for us to search in 2024. With the best savings account, it sets us apart in managing well our financial status.

I have started researching different offerings from various banks, focusing on savings accounts with high-interest rates. By doing this research, wish to help Malaysians maximize their savings in a dynamic economic landscape, ensuring their hard-earned money grows efficiently. Let’s have a good start in 2024 with the best savings account with a high savings interest rate.

Understanding Saving Accounts

Saving accounts are fundamental to personal finance, especially in Malaysia, where choosing the right one can significantly impact your financial health. These accounts provide a secure and accessible place to store your money, often earning interest over time.

The importance of saving accounts lies in their role in financial planning:

- Safety and Security: Saving accounts offer a secure place to keep your money. In Malaysia, they’re often insured under schemes like PIDM, adding an extra layer of protection.

- Earning Interest: While the interest rates might be lower compared to other investment vehicles, saving accounts provide a steady, risk-free return on your money.

- Liquidity: Unlike investments in stocks or bonds, saving accounts offer easy access to funds, making them ideal for emergency savings or short-term financial goals.

- Budgeting and Saving: They are excellent tools for budgeting. Regular deposits help inculcate a saving habit, crucial for long-term financial stability.

Factors to Consider For Choosing A Saving Account

When looking for the best savings account in Malaysia, several factors are key to making the right choice:

- Interest Rates: Higher rates mean more earnings on your savings. Compare rates across banks.

- Fees and Charges: Look for accounts with low or no maintenance fees.

- Minimum Balance Requirements: Some accounts require a minimum balance, choose one that suits your financial capability.

- Accessibility and Convenience: Easy access to your funds and convenient banking services are important.

- Additional Benefits: Some accounts offer extra perks like online banking, debit cards, or reward programs.

- Reputation and Reliability of the Bank: Choose a bank known for its stability and good customer service.

Top 10 Bank That Offering the Highest Interest Rate

|

Savings Account |

Interest / Profit Rate |

|

6.15% p.a. |

|

|

6.00% p.a. |

|

|

5% p.a. |

|

|

4.15% p.a. |

|

|

3.35% p.a. |

|

|

3.25% p.a. |

|

|

3.20% p.a. |

|

|

3.00% p.a. |

|

|

2.50% p.a. |

|

|

2.40% p.a. |

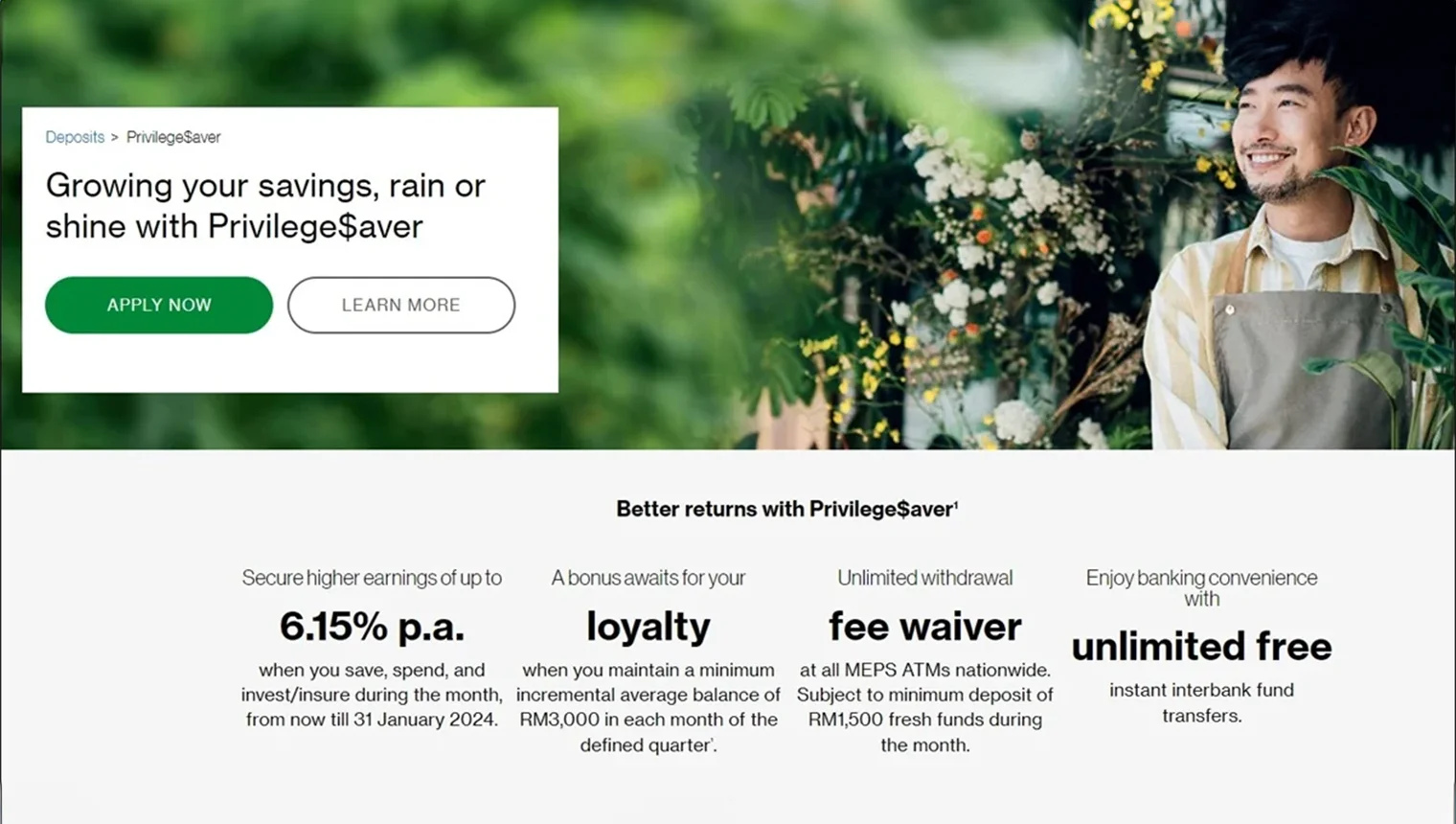

Standard Chartered Privilege$aver

Introduction

Standard Chartered Privilege$aver is a high-interest savings account, ideal for those who actively manage their finances. It caters to users looking to maximize their savings through various banking activities.

Interest Rate Offer

It offers a tiered interest rate, of up to 6.15% p.a., making it one of the highest in Malaysia.

PIDM Protection

This account is covered under PIDM (Perbadanan Insurans Deposit Malaysia), ensuring the safety of your deposits.

Features

|

Feature |

Description |

|

Base Interest Rate |

0.05% p.a. |

|

Deposit Bonus |

Additional 0.70% p.a. for monthly deposits of at least RM3,000 |

|

Card Bonus |

Up to 1.40% p.a. for spending on linked debit and credit card |

|

Interest/Insure Bonus |

2% p.a. for investing in unit trust or purchasing insurance with a minimum premium |

|

Loyalty Bonus |

2% p.a. for increasing average monthly balance by RM3,000 |

|

Interest Cap |

Bonus interest on up to RM100,000 of monthly average balance |

UOB One Account

Introduction

The UOB One Account is a popular choice in Malaysia for those seeking a high-interest savings account. It’s designed for users who can meet certain transaction conditions, offering attractive interest rates.

Interest Rate Offer

This account offers tiered interest rates, up to 6.00% p.a., making it a competitive choice.

PIDM Protection

Deposits in the UOB One Account are protected under PIDM, ensuring security for your funds.

Features

|

Feature |

Description |

|

Base Interest Rate |

0.10% p.a. |

|

Balance Requirement for Maximum Rate |

RM50,000 to RM100,000 |

|

Account Opening Bonus |

Introductory bonus for new customers, valid for 6 months |

|

Salary Credit |

Bonus interest for crediting a minimum salary of RM2,000 monthly |

|

Card Spending |

Minimum monthly spend of RM500 on UOB debit or credit card |

|

Bill Payments |

Pay at least 3 bills online monthly to earn extra interest |

|

Direct Debit Payments |

Make 3 direct debit payments monthly for additional interest |

|

Monthly Deposit |

Deposit a minimum of RM2,000 monthly via specific transfer methods |

Rize Commodity Murabahah Savings Account-i

Introduction

The Rize Commodity Murabahah Savings Account-i, offered by Rize, a fully digital bank, is an innovative, Shariah-compliant savings option. It’s designed for tech-savvy users seeking convenient, high-profit online banking.

Interest Rate Offer

This account offers a profit rate of up to 5% p.a., which is especially appealing for smaller deposits.

PIDM Protection

As with many Malaysian bank accounts, it is covered under PIDM, ensuring the safety of deposits.

Features

|

Feature |

Description |

|

Profit Rate |

Up to 5% p.a. |

|

Digital Banking |

Fully online services, ideal for tech-savvy savers |

|

Special Deposit Rate Campaign |

5% p.a. profit rate on the first RM5,000 deposited for six months |

|

Subsequent Amounts |

4% p.a. on amounts above RM5,001 |

|

Account Access |

Services available exclusively online |

Hong Leong Bank Pay&Save Account

Introduction

The Hong Leong Bank Pay&Save Account is a dynamic saving option for those who actively use their account for various transactions. It combines saving with spending and investment activities.

Interest Rate Offer

This account offers an interest rate of up to 4.15% p.a., based on specific activities.

PIDM Protection

Deposits in the Pay&Save account are protected under PIDM, safeguarding your money.

Features

|

Feature |

Description |

|

Base Interest Rate |

Variable based on activities |

|

Monthly Deposit Requirement |

RM2,000 for Savings Interest of 2.25% p.a. |

|

Online Payment Bonus |

0.50% p.a. for a minimum spend of RM500 online |

|

Debit Card Spend |

0.50% p.a. for retail transactions of at least RM500 |

|

Share Trading Bonus |

Up to 0.90% p.a. for trading in shares, with tiers based on trade volume |

|

Caps on Earnings |

Interest caps on balances up to RM100,000 |

RHB Smart Account/-i

Introduction

The RHB Smart Account/-i is designed for those who prefer an integrated banking experience. It encourages various banking activities to maximize interest earnings.

Interest Rate Offer

This account offers a tiered interest rate, reaching up to 3.35% p.a., depending on the fulfillment of certain criteria.

PIDM Protection

The RHB Smart Account/-i is covered under PIDM, ensuring the safety and security of your deposits.

Features

|

Feature |

Description |

|

Base Interest Rate |

0.05% p.a. for maintaining a minimum balance of RM1,000 |

|

Save Category Bonus |

Earn up to 1.80% p.a. for depositing RM2,000 monthly |

|

Pay Category Bonus |

Up to 1.50% p.a. for paying a minimum of 6 bills |

|

Spend Category Bonus |

Up to 1.50% p.a. for spending RM2,500 via credit/debit card |

|

Financing Category Bonus |

Up to 1.50% p.a. for home/auto financing payments |

|

Trade and Convert Categories |

Additional interest for trading and currency conversions |

|

Cap on Bonus Interest |

Maximum bonus interest capped at 3.30% p.a. |

OCBC 360

Introduction

OCBC 360 is a versatile savings account that rewards customers for fulfilling various banking activities. It’s designed for those who want to integrate their everyday banking activities with their savings.

Interest Rate Offer

This account offers a tiered interest rate of up to 3.25% p.a., based on completing specific banking transactions.

PIDM Protection

Deposits in the OCBC 360 account are safeguarded under PIDM, ensuring the safety of your funds.

Features

|

Feature |

Description |

|

Base Interest Rate |

0.10% p.a. |

|

Deposit Bonus |

Earn 1.05% p.a. for depositing a minimum of RM500 monthly |

|

Bill Payment Bonus |

Additional 1.05% p.a. for paying at least 3 bills via online banking |

|

Card Spend Bonus |

1.05% p.a. for spending at least RM500 on OCBC cards |

|

Total Potential Interest |

Up to 3.25% p.a. combining all bonuses |

|

Cap on Interest |

Applicable on the first RM100,000 of your balance |

|

Special Campaign |

New customers can earn up to 4.20% p.a. (until 29 Feb 2024) |

UOB Stash

Introduction

UOB Stash is a savings account that rewards customers for maintaining and growing their account balance. It’s tailored for those who can consistently save and increase their deposits.

Interest Rate Offer

This account offers a tiered interest rate system, with rates up to 3.20% p.a., favoring higher account balances.

PIDM Protection

The UOB Stash account is protected under PIDM, ensuring security for depositors.

Features

|

Feature |

Description |

|

Base Interest Rate |

0.05% p.a. |

|

Account Balance Tiers |

Different rates for different balance ranges |

|

Maximum Interest Rate |

3.20% p.a. for balances above RM100,000 |

|

Balance Cap for Bonus Interest |

Applicable up to RM200,000 |

|

Increased Base Rate |

1.60% p.a. for balances exceeding RM200,000 |

|

Effective Interest Rate |

Varies with the account balance |

Alliance SavePlus Account

Introduction

The Alliance SavePlus Account stands out for its high-interest rates and is tailored for those looking to deposit large sums. It combines features of both savings and current accounts.

Interest Rate Offer

The account offers up to 3.00% p.a., depending on the account balance.

PIDM Protection

Funds in the Alliance SavePlus Account are protected under PIDM.

Features

|

Feature |

Description |

|

Interest Rate |

Up to 3.00% p.a. for balances above RM500,000 |

|

Lower Balance Rates |

0% to 2.85% p.a. for lower balances |

|

Minimum Balance |

Higher interest rates for maintaining a high balance |

|

Additional Benefits |

Waivers for various banking services and fees |

|

Account Type |

Functions as a hybrid of savings and current accounts |

Affin Invikta Account/-i

Introduction

The Affin Invikta Account/-i is a premium savings account, designed for high-net-worth individuals. It’s part of Affin Bank’s exclusive banking services, offering competitive interest rates.

Interest Rate Offer

The account offers a tiered interest rate of up to 2.50% p.a., based on the account balance.

PIDM Protection

Deposits in the Affin Invikta Account/-i are protected under PIDM.

Features

|

Feature |

Description |

|

Interest Rate |

Up to 2.50% p.a. for balances between RM250,000 to RM2,499,999.99 |

|

Lower Balance Rates |

0% to 1.85% p.a. for balances below RM250,000 |

|

Account Eligibility |

By invitation only, part of premium banking services |

|

Additional Perks |

Access to exclusive banking benefits and services |

AmBank eFlex/-i

Introduction

The AmBank eFlex/-i account is a flexible, online-exclusive savings option. It’s designed for customers who prefer digital banking and offers competitive interest rates.

Interest Rate Offer

This account provides a tiered interest rate, up to 2.40% p.a., based on maintaining a certain account balance.

PIDM Protection

The AmBank eFlex/-i is protected under PIDM, ensuring the security of deposited funds.

Features

|

Feature |

Description |

|

Base Interest Rate |

0.5% p.a. for any balance |

|

Higher Interest Rate |

Up to 2.40% p.a. for balances of RM20,000 and above |

|

Account Accessibility |

Online application and management via AmOnline Mobile app |

|

Account Type |

Online-exclusive product, offering ease of digital transactions |

Other New Saving Account That offered high saving interest rate

|

Savings Account |

Interest / Profit Rate |

|

1% p.a. |

|

|

1.50% p.a. |

|

|

3.41% p.a. |

|

|

3.00% p.a. |

|

|

5.00% p.a. |

myPTPTN

Introduction

myPTPTN is a unique option, particularly beneficial for those saving for educational purposes, providing not only interest earnings but also additional benefits like tax relief. It is primarily designed to encourage savings for higher education, offering attractive returns and benefits.

Interest Rate Offer

This account offers an interest rate of 1% p.a., aimed at providing steady growth for educational savings.

PIDM Protection

It is important to note that myPTPTN savings may not be covered under PIDM, as it is a government-led educational fund.

Features

|

Feature |

Description |

|

Account Purpose |

Encourages saving for higher education expenses |

|

Accessibility |

Can be accessed and managed through PTPTN’s online portal |

|

Government-Backed |

Supported by the Malaysian government |

|

Flexible Deposits |

Allows for flexible deposit amounts and frequencies |

|

Tax Relief |

Contributions are eligible for tax relief in Malaysia |

GO+ Touch n Go Investment

Introduction

GO+ Touch n Go Investment is a unique financial product that combines the convenience of a Touch n Go eWallet with the benefits of an investment account. It is designed to provide users with a flexible way to grow their money.

Interest Rate Offer

This investment offers an average return of 1.5% p.a., though it’s important to note that this rate can vary as it is dependent on the performance of the underlying funds.

PIDM Protection

As GO+ is an investment product rather than a traditional savings account, it does not fall under the protection of PIDM.

Features

|

Feature |

Description |

|

Integration with eWallet |

Seamlessly linked to Touch n Go eWallet |

|

Investment Type |

Money market investment |

|

Liquidity |

Allows for instant access to funds via the eWallet |

|

Minimum Investment |

Low entry point for investment, which minimum reload is RM10 |

|

Usage |

Funds can be used for all Touch n Go eWallet transactions |

Versa

Introduction

Versa is a digital cash management platform in Malaysia, offering an innovative way to grow savings. It provides an alternative to traditional fixed deposits, with a focus on flexibility and higher returns.

Interest Rate Offer

Versa offers an attractive average interest rate of 3.41% p.a., which is significantly higher than many conventional savings accounts.

PIDM Protection

As a digital investment platform, Versa is not covered by PIDM. Instead, investments are subject to market risks and returns are not guaranteed.

Features

|

Feature |

Description |

|

Investment Approach |

Money market funds for higher potential returns |

|

Accessibility |

Fully digital platform for easy access and management |

|

Withdrawal Flexibility |

No lock-in period, allowing for quick withdrawals |

|

Minimum Investment |

Low minimum investment requirement, which minimum reload is RM100 |

|

Automated Savings |

Option to automate savings with scheduled deposits |

GX Bank

Introduction

GX Bank is a new entrant in the Malaysian banking sector, known for its digital-first approach. It caters to tech-savvy users seeking modern banking solutions with competitive interest rates.

Interest Rate Offer

GX Bank offers a promising interest rate of 3.00% p.a., positioning itself as a strong contender in the digital banking space.

PIDM Protection

As a licensed banking institution, deposits in GX Bank are protected under PIDM, ensuring security for customers’ funds.

Features

|

Feature |

Description |

|

Digital Banking |

Complete online banking experience |

|

Interest Rate |

Attractive rate of 3.00% p.a. |

|

Account Accessibility |

Easy access through mobile and online platforms |

|

Innovative Services |

Modern banking services tailored for a digital audience |

|

Customer Support |

Robust digital customer support for convenience |

Rize

Introduction

Rize is a pioneering fully digital bank in Malaysia, operated by Al-Rajhi Bank. It offers a modern banking experience with a focus on convenience and attractive returns, catering especially to tech-savvy users.

Interest Rate Offer

Rize provides a competitive interest rate, with up to 5% p.a. on savings, particularly appealing for smaller deposits and those looking for higher returns.

PIDM Protection

As a digital banking service offered by Al-Rajhi Bank, deposits in Rize are covered under PIDM, offering security and peace of mind to depositors.

Features

|

Feature |

Description |

|

Digital-Only Services |

Fully online banking services, accessible via digital platforms |

|

Profit Rate |

Up to 5% p.a., one of the highest in the market |

|

Special Deposit Rate Campaign |

Higher rates for initial deposits (until 31 Mar 2024) |

|

Accessibility |

Convenient account management through digital channels |

|

Shariah-Compliant |

Offers Islamic banking principles for its products |

Conclusion

In Malaysia, choosing the best saving account hinges on individual financial goals and preferences. For traditional banking, Standard Chartered’s Privilege$aver is exemplary with its high interest rates, appealing to active savers. In contrast, for those embracing digital trends, Rize stands out with its competitive 5% p.a. interest rate and fully online banking experience.

These choices encapsulate the diversity within Malaysia’s banking sector, catering to different preferences and financial goals. Whether you lean towards the established reliability of conventional banks or the dynamic offerings of digital platforms, there’s a saving solution tailored to every individual’s journey toward financial growth.

Faq

What is PIDM?

PIDM (Perbadanan Insurans Deposit Malaysia) insures deposits and protects bank customers in Malaysia.

Which savings account has the highest interest rate in Malaysia?

Standard Chartered Privilege$aver offers one of the highest interest rates, up to 6.15% p.a.

Which saving account best for students?

Maybank Yippie Savings Account is popular among students for its benefits and lower requirements.

Which saving account best for senior citizen?

Hong Leong Bank’s Senior Savers Flexi Account is favorable for senior citizens, offering higher interest and other benefits.

What is the safest bank for saving account in Malaysia?

All major banks like Maybank, CIMB, and Public Bank are considered safe, as they are protected by PIDM.

Related Article: